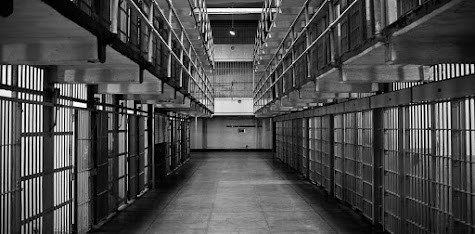

Who Owns Private Prisons? Most Likely, Not You!

By Amy Orr

The Bill and Melinda Gates Foundation has been on the receiving end of public scrutiny for its controversial holdings in America’s two largest private prison companies – the Corrections Corporation of America (CCA) and the GEO Group (GEO). Why the controversy? Because CCA and GEO are notorious for their aggressive drive toward profit maximization at all costs – even in ways that exacerbate the social inequities that the Gates Foundation is supposedly organized to fix.

Before jumping on the bandwagon of criticizing Gates’ Foundation investments, we at the FB Heron Foundation decided to take a look at our own portfolio. We learned that Heron is also passively invested in GEO and CCA. In fact, anyone with broad passive exposure to the U.S. equity market through his or her pension or 401(k) plan is likely to have ownership of both companies. Surprise! Gates isn’t the only one.

Like many private foundations, Gates invests its Asset Trust with one objective: to maximize financial return on investments in order to grow capital to support the foundation’s philanthropic efforts. As a result, investment goals are considered separately from grant-making objectives. Considering this frame, private prisons are indeed an attractive investment that have the potential to yield stable financial return to an investor.

The demand for prison space is higher today than it has ever been and private detention facilities have grown to meet this demand. The federal private inmate population has increased by nearly 80 percent in the past decade, more than four times the growth rate of the total prison population (18 percent). Private prison companies have capital to invest in building and real estate, and in turn, benefit from stable revenues through subsidies and multi-year government contracts. They also have the ability to cut costs in ways that public prison systems cannot – via slashing healthcare and workforce reintegration costs. The business case has paid off to investors, as GEO and CCA stock prices have yielded annualized 10-year returns of 20.43 percent and 15.57 percent, respectively.

The reality is that very few of us — foundations or individuals — understand how externalized costs are fueling such strong investment returns, because most of the investment vehicles available to us are lacking in transparency. Those that do make the effort to look under the hood quickly find that data sources are deceiving. For example, private prisons are classified as Real Estate Investment Trusts (REITs), making it difficult for investors to know where to look for such investments. Private prisons could also mistakenly be flagged through data screens as “job creators” but it is unclear in annual reports how much of the workforce is comprised of inmates required by law to work and paid between 23 cents and $1.15 per hour for their labor.

Investors don’t have the tools they need to see how externalized costs are shouldered by inmates, their families, communities and ultimately taxpayers due to higher rates of assault and rape that occur in private prisons; cuts in health care spending and lack of resources to address PTSD and other mental illnesses commonly diagnosed in inmates; and the general lack of programming aimed at helping re-integrate inmates into society, find gainful employment and avoid re-arrest.

The FB Heron Foundation has embarked on the path of understanding the externalities (positive and negative) of our investments, and looking beyond the financial return to an investor to understand how such externalities are contributing to or detracting from our mission. Although we still have small investments in CCA and GEO today, we plan to divest from these and other enterprises that we consider to be net extractors. We consider ourselves legally obliged to make this change given our fiduciary duties as a tax-privileged organization (see Investment Policy Statement).

We encourage others to invest with the same premise but understand that the system itself is as much to blame as any individual investor. Ultimately, as investors and members of society we must demand a level of transparency in our investment portfolios that allows us to invest in enterprises that support a thriving society.

Image credits: 1) Courtesy of Bloomberg 2) The Prison Index

Amy Orr is the Director of Capital Deployment for the FB Heron Foundation.

Comments

Post a Comment