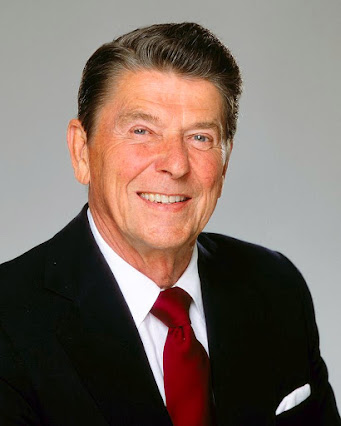

President Ronald Reagan's Economic Policies

Reagan and the Economy

Ronald Reagan was U.S. President from January 20, 1981 – January 20, 1989. He was the first conservative President in more than 50 years. However, he was similar to President Obama in one respect -- the first task of each was to combat the worst recession sincethe Great Depression.

That's where their paths differed greatly. Reagan promised the "Reagan Revolution," which was based on reducing government spending, taxes and regulation.

His philosophy was "Government is not the solution to our problem, government is the problem."1980-1981 Recession

Reagan inherited an economy mired in stagflation -- a combination of double-digit economic contraction with double-digit inflation. To combat recession, Reagan aggressively cut income taxes from 70% to 28% for the top income tax rate, and from 48% to 34% for the corporate tax rate. He also promised to reduce government spending and regulations, while reducing themoney supply to combat inflation.

Reaganomics

Reagan's economic policies are known as Reaganomics. Reagan based his policies on the theory of supply side economics, which states that tax cuts encourage economic expansion enough to eventually broaden the tax base. In time, the increased revenue from a stronger economy offsets the initial revenue loss from the tax cuts. Reagan's tax cuts worked because tax rates were so high in the early '80s that they were in the "Prohibitive Range," according to the Laffer Curve.

Reagan and Deregulation

Reagan was applauded for continuing to eliminate the Nixon-era price controls

These were blamed for constraining the free-market equilibrium that would have prevented inflation. Reagan further removed controls on oil and gas, cable television and long-distance phone service, as well as interstate bus service and ocean shipping.

Bank regulations were eased. In 1982, the Garn-St. Germain Depository Institutions Act was passed, which removed restrictions on loan-to-value ratios for Savings and Loan banks. Reagan's budget cut also reduced regulatory staff at the Federal Home Loan Bank Board. As a result, banks invested in risky real estate ventures (sound familiar?). Reagan's deregulation and budget cutting contributed to the Savings and Loan Crisis of 1989.

Import barriers were actually increased, as Reagan doubled the number of items that were subject to trade restraint from 12% in 1980 to 23% in 1988. Little was done in other regulations affecting health, safety, and the environment. In fact, although Reagan reduced regulations, it was at a slower pace than under Carter. (Source: William A. Niskanen, Reaganomics, The Concise Encyclopedia of Economics)

Did Reagan Reduce Government Spending?

Despite campaigning on a reduced role for government, Reagan wasn't as successful as he was at tax cuts. During his first year, he cut domestic programs by $39 billion. However, he increased defense spending to achieve "peace through strength" in his opposition to Communism and the Soviet Union. He was successful in ending the Cold War, with the famous quote "Mr. Gorbachev, tear down this wall." However, to accomplish these goals, Reagan wound up increasing the defense budget by 35%.

Reagan did not reduce other government programs. He expanded Medicare, and increased the payroll tax to insure the solvency of Social Security. Under Reagan, government spending increased 2.5% annually. By the end of Reagan's two terms, the national debt had more than doubled.

Beating Inflation

Reagan captured the mood of voters when he said, "Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man." To combat inflation, Federal Reserve Chairman Paul Volckersteadily raised the Fed funds rate to 20%, successfully ending double-digit inflation.

However, it also triggered the resumption of recession, lasting from July 1981 - November 1982. Thiscontractionary monetary policy reduced business spending. This resulted in a 10.8% unemployment rate, the highest in any recession. Unemployment remained above 10% for nearly a year.

Council of Economic Advisers

During his eight-year term, Reagan brought on board many well-known economists to the Council of Economic Advisers, including Murry Weidenbaum, Martin Feldstein and Beryl Sprinkel as Chairmen. The Council also included William Niskanen, one of the founders of Reaganomics, as well as Jerry Jordan, William Poole, Thomas Gale Moore and Michael Mussa. The staff included Nobel Prize winner and New York Times columnist Paul Krugman and Harvard professor Larry Summers, who later became President Obama's Director of the National Economic Council.

Reagan's Early Years

Ronald Reagan was born on February 6, 1911. He received a BA in economics and sociology from Eureka College in Illinois. He became a radio sports announcer, then an actor in 53 films. After becoming president of the Screen Actors Guild, he became conservative after becoming involved in rooting out Communism in the film industry. He became a TV host and spokesman for conservatism. He was Governor of California from 1966-1974.

In 1980, Reagan was nominated as the Republican Presidential candidate, with George H.W. Bush as Vice-Presidential nominee. He beat Jimmy Carter, becoming the 40th President of the United States from 1981-1989. (Source: White House, Ronald Reagan) Article updated February 21, 2013

Comments

Post a Comment